| diagram |  |

||

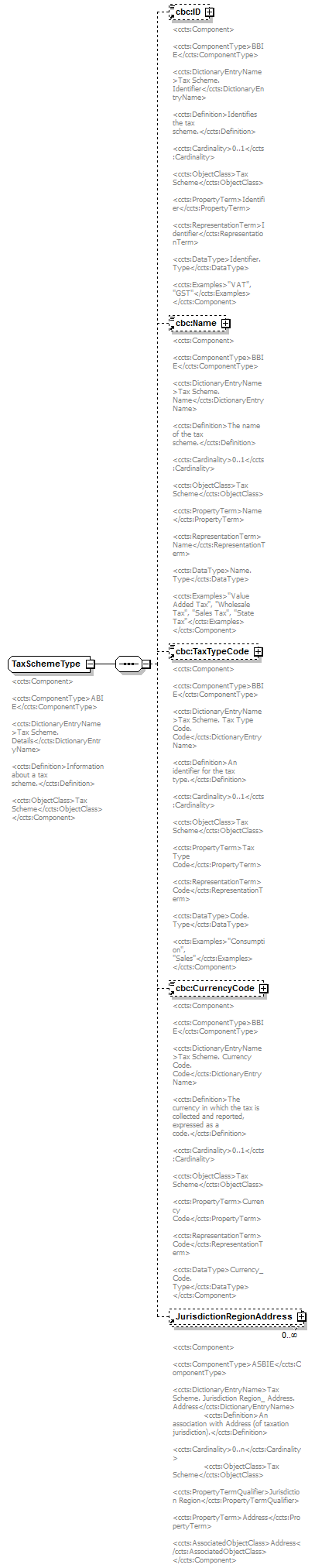

| namespace | urn:oasis:names:specification:ubl:schema:xsd:CommonAggregateComponents-2 | ||

| children | ID Name TaxTypeCode CurrencyCode JurisdictionRegionAddress | ||

| used by |

|

||

| annotation |

|

||

| source | <xs:complexType name="TaxSchemeType"> <xs:annotation> <xs:documentation> <ccts:Component> <ccts:ComponentType>ABIE</ccts:ComponentType> <ccts:DictionaryEntryName>Tax Scheme. Details</ccts:DictionaryEntryName> <ccts:Definition>Information about a tax scheme.</ccts:Definition> <ccts:ObjectClass>Tax Scheme</ccts:ObjectClass> </ccts:Component> </xs:documentation> </xs:annotation> <xs:sequence> <xs:element ref="cbc:ID" minOccurs="0" maxOccurs="1"> <xs:annotation> <xs:documentation> <ccts:Component> <ccts:ComponentType>BBIE</ccts:ComponentType> <ccts:DictionaryEntryName>Tax Scheme. Identifier</ccts:DictionaryEntryName> <ccts:Definition>Identifies the tax scheme.</ccts:Definition> <ccts:Cardinality>0..1</ccts:Cardinality> <ccts:ObjectClass>Tax Scheme</ccts:ObjectClass> <ccts:PropertyTerm>Identifier</ccts:PropertyTerm> <ccts:RepresentationTerm>Identifier</ccts:RepresentationTerm> <ccts:DataType>Identifier. Type</ccts:DataType> <ccts:Examples>"VAT", "GST"</ccts:Examples> </ccts:Component> </xs:documentation> </xs:annotation> </xs:element> <xs:element ref="cbc:Name" minOccurs="0" maxOccurs="1"> <xs:annotation> <xs:documentation> <ccts:Component> <ccts:ComponentType>BBIE</ccts:ComponentType> <ccts:DictionaryEntryName>Tax Scheme. Name</ccts:DictionaryEntryName> <ccts:Definition>The name of the tax scheme.</ccts:Definition> <ccts:Cardinality>0..1</ccts:Cardinality> <ccts:ObjectClass>Tax Scheme</ccts:ObjectClass> <ccts:PropertyTerm>Name</ccts:PropertyTerm> <ccts:RepresentationTerm>Name</ccts:RepresentationTerm> <ccts:DataType>Name. Type</ccts:DataType> <ccts:Examples>"Value Added Tax", "Wholesale Tax", "Sales Tax", "State Tax"</ccts:Examples> </ccts:Component> </xs:documentation> </xs:annotation> </xs:element> <xs:element ref="cbc:TaxTypeCode" minOccurs="0" maxOccurs="1"> <xs:annotation> <xs:documentation> <ccts:Component> <ccts:ComponentType>BBIE</ccts:ComponentType> <ccts:DictionaryEntryName>Tax Scheme. Tax Type Code. Code</ccts:DictionaryEntryName> <ccts:Definition>An identifier for the tax type.</ccts:Definition> <ccts:Cardinality>0..1</ccts:Cardinality> <ccts:ObjectClass>Tax Scheme</ccts:ObjectClass> <ccts:PropertyTerm>Tax Type Code</ccts:PropertyTerm> <ccts:RepresentationTerm>Code</ccts:RepresentationTerm> <ccts:DataType>Code. Type</ccts:DataType> <ccts:Examples>"Consumption", "Sales"</ccts:Examples> </ccts:Component> </xs:documentation> </xs:annotation> </xs:element> <xs:element ref="cbc:CurrencyCode" minOccurs="0" maxOccurs="1"> <xs:annotation> <xs:documentation> <ccts:Component> <ccts:ComponentType>BBIE</ccts:ComponentType> <ccts:DictionaryEntryName>Tax Scheme. Currency Code. Code</ccts:DictionaryEntryName> <ccts:Definition>The currency in which the tax is collected and reported, expressed as a code.</ccts:Definition> <ccts:Cardinality>0..1</ccts:Cardinality> <ccts:ObjectClass>Tax Scheme</ccts:ObjectClass> <ccts:PropertyTerm>Currency Code</ccts:PropertyTerm> <ccts:RepresentationTerm>Code</ccts:RepresentationTerm> <ccts:DataType>Currency_ Code. Type</ccts:DataType> </ccts:Component> </xs:documentation> </xs:annotation> </xs:element> <xs:element ref="JurisdictionRegionAddress" minOccurs="0" maxOccurs="unbounded"> <xs:annotation> <xs:documentation> <ccts:Component> <ccts:ComponentType>ASBIE</ccts:ComponentType> <ccts:DictionaryEntryName>Tax Scheme. Jurisdiction Region_ Address. Address</ccts:DictionaryEntryName> <ccts:Definition>An association with Address (of taxation jurisdiction).</ccts:Definition> <ccts:Cardinality>0..n</ccts:Cardinality> <ccts:ObjectClass>Tax Scheme</ccts:ObjectClass> <ccts:PropertyTermQualifier>Jurisdiction Region</ccts:PropertyTermQualifier> <ccts:PropertyTerm>Address</ccts:PropertyTerm> <ccts:AssociatedObjectClass>Address</ccts:AssociatedObjectClass> </ccts:Component> </xs:documentation> </xs:annotation> </xs:element> </xs:sequence> </xs:complexType> |

XML Schema documentation generated by XMLSpy Schema Editor http://www.altova.com/xmlspy