| diagram |  |

||

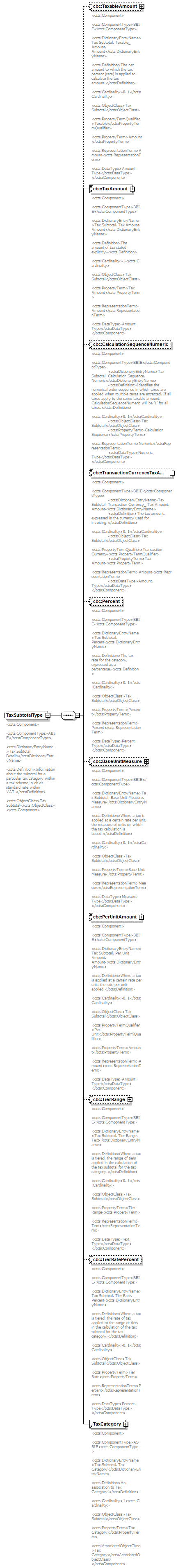

| namespace | urn:oasis:names:specification:ubl:schema:xsd:CommonAggregateComponents-2 | ||

| children | TaxableAmount TaxAmount CalculationSequenceNumeric TransactionCurrencyTaxAmount Percent BaseUnitMeasure PerUnitAmount TierRange TierRatePercent TaxCategory | ||

| used by |

|

||

| annotation |

|

||

| source | <xs:complexType name="TaxSubtotalType"> <xs:annotation> <xs:documentation> <ccts:Component> <ccts:ComponentType>ABIE</ccts:ComponentType> <ccts:DictionaryEntryName>Tax Subtotal. Details</ccts:DictionaryEntryName> <ccts:Definition>Information about the subtotal for a particular tax category within a tax scheme, such as standard rate within VAT.</ccts:Definition> <ccts:ObjectClass>Tax Subtotal</ccts:ObjectClass> </ccts:Component> </xs:documentation> </xs:annotation> <xs:sequence> <xs:element ref="cbc:TaxableAmount" minOccurs="0" maxOccurs="1"> <xs:annotation> <xs:documentation> <ccts:Component> <ccts:ComponentType>BBIE</ccts:ComponentType> <ccts:DictionaryEntryName>Tax Subtotal. Taxable_ Amount. Amount</ccts:DictionaryEntryName> <ccts:Definition>The net amount to which the tax percent (rate) is applied to calculate the tax amount.</ccts:Definition> <ccts:Cardinality>0..1</ccts:Cardinality> <ccts:ObjectClass>Tax Subtotal</ccts:ObjectClass> <ccts:PropertyTermQualifier>Taxable</ccts:PropertyTermQualifier> <ccts:PropertyTerm>Amount</ccts:PropertyTerm> <ccts:RepresentationTerm>Amount</ccts:RepresentationTerm> <ccts:DataType>Amount. Type</ccts:DataType> </ccts:Component> </xs:documentation> </xs:annotation> </xs:element> <xs:element ref="cbc:TaxAmount" minOccurs="1" maxOccurs="1"> <xs:annotation> <xs:documentation> <ccts:Component> <ccts:ComponentType>BBIE</ccts:ComponentType> <ccts:DictionaryEntryName>Tax Subtotal. Tax Amount. Amount</ccts:DictionaryEntryName> <ccts:Definition>The amount of tax stated explicitly.</ccts:Definition> <ccts:Cardinality>1</ccts:Cardinality> <ccts:ObjectClass>Tax Subtotal</ccts:ObjectClass> <ccts:PropertyTerm>Tax Amount</ccts:PropertyTerm> <ccts:RepresentationTerm>Amount</ccts:RepresentationTerm> <ccts:DataType>Amount. Type</ccts:DataType> </ccts:Component> </xs:documentation> </xs:annotation> </xs:element> <xs:element ref="cbc:CalculationSequenceNumeric" minOccurs="0" maxOccurs="1"> <xs:annotation> <xs:documentation> <ccts:Component> <ccts:ComponentType>BBIE</ccts:ComponentType> <ccts:DictionaryEntryName>Tax Subtotal. Calculation Sequence. Numeric</ccts:DictionaryEntryName> <ccts:Definition>Identifies the numerical order sequence in which taxes are applied when multiple taxes are attracted. If all taxes apply to the same taxable amount, CalculationSequenceNumeric will be '1' for all taxes.</ccts:Definition> <ccts:Cardinality>0..1</ccts:Cardinality> <ccts:ObjectClass>Tax Subtotal</ccts:ObjectClass> <ccts:PropertyTerm>Calculation Sequence</ccts:PropertyTerm> <ccts:RepresentationTerm>Numeric</ccts:RepresentationTerm> <ccts:DataType>Numeric. Type</ccts:DataType> </ccts:Component> </xs:documentation> </xs:annotation> </xs:element> <xs:element ref="cbc:TransactionCurrencyTaxAmount" minOccurs="0" maxOccurs="1"> <xs:annotation> <xs:documentation> <ccts:Component> <ccts:ComponentType>BBIE</ccts:ComponentType> <ccts:DictionaryEntryName>Tax Subtotal. Transaction Currency_ Tax Amount. Amount</ccts:DictionaryEntryName> <ccts:Definition>The tax amount, expressed in the currency used for invoicing.</ccts:Definition> <ccts:Cardinality>0..1</ccts:Cardinality> <ccts:ObjectClass>Tax Subtotal</ccts:ObjectClass> <ccts:PropertyTermQualifier>Transaction Currency</ccts:PropertyTermQualifier> <ccts:PropertyTerm>Tax Amount</ccts:PropertyTerm> <ccts:RepresentationTerm>Amount</ccts:RepresentationTerm> <ccts:DataType>Amount. Type</ccts:DataType> </ccts:Component> </xs:documentation> </xs:annotation> </xs:element> <xs:element ref="cbc:Percent" minOccurs="0" maxOccurs="1"> <xs:annotation> <xs:documentation> <ccts:Component> <ccts:ComponentType>BBIE</ccts:ComponentType> <ccts:DictionaryEntryName>Tax Subtotal. Percent</ccts:DictionaryEntryName> <ccts:Definition>The tax rate for the category, expressed as a percentage.</ccts:Definition> <ccts:Cardinality>0..1</ccts:Cardinality> <ccts:ObjectClass>Tax Subtotal</ccts:ObjectClass> <ccts:PropertyTerm>Percent</ccts:PropertyTerm> <ccts:RepresentationTerm>Percent</ccts:RepresentationTerm> <ccts:DataType>Percent. Type</ccts:DataType> </ccts:Component> </xs:documentation> </xs:annotation> </xs:element> <xs:element ref="cbc:BaseUnitMeasure" minOccurs="0" maxOccurs="1"> <xs:annotation> <xs:documentation> <ccts:Component> <ccts:ComponentType>BBIE</ccts:ComponentType> <ccts:DictionaryEntryName>Tax Subtotal. Base Unit Measure. Measure</ccts:DictionaryEntryName> <ccts:Definition>Where a tax is applied at a certain rate per unit, the measure of units on which the tax calculation is based.</ccts:Definition> <ccts:Cardinality>0..1</ccts:Cardinality> <ccts:ObjectClass>Tax Subtotal</ccts:ObjectClass> <ccts:PropertyTerm>Base Unit Measure</ccts:PropertyTerm> <ccts:RepresentationTerm>Measure</ccts:RepresentationTerm> <ccts:DataType>Measure. Type</ccts:DataType> </ccts:Component> </xs:documentation> </xs:annotation> </xs:element> <xs:element ref="cbc:PerUnitAmount" minOccurs="0" maxOccurs="1"> <xs:annotation> <xs:documentation> <ccts:Component> <ccts:ComponentType>BBIE</ccts:ComponentType> <ccts:DictionaryEntryName>Tax Subtotal. Per Unit_ Amount. Amount</ccts:DictionaryEntryName> <ccts:Definition>Where a tax is applied at a certain rate per unit, the rate per unit applied.</ccts:Definition> <ccts:Cardinality>0..1</ccts:Cardinality> <ccts:ObjectClass>Tax Subtotal</ccts:ObjectClass> <ccts:PropertyTermQualifier>Per Unit</ccts:PropertyTermQualifier> <ccts:PropertyTerm>Amount</ccts:PropertyTerm> <ccts:RepresentationTerm>Amount</ccts:RepresentationTerm> <ccts:DataType>Amount. Type</ccts:DataType> </ccts:Component> </xs:documentation> </xs:annotation> </xs:element> <xs:element ref="cbc:TierRange" minOccurs="0" maxOccurs="1"> <xs:annotation> <xs:documentation> <ccts:Component> <ccts:ComponentType>BBIE</ccts:ComponentType> <ccts:DictionaryEntryName>Tax Subtotal. Tier Range. Text</ccts:DictionaryEntryName> <ccts:Definition>Where a tax is tiered, the range of tiers applied in the calculation of the tax subtotal for the tax category.</ccts:Definition> <ccts:Cardinality>0..1</ccts:Cardinality> <ccts:ObjectClass>Tax Subtotal</ccts:ObjectClass> <ccts:PropertyTerm>Tier Range</ccts:PropertyTerm> <ccts:RepresentationTerm>Text</ccts:RepresentationTerm> <ccts:DataType>Text. Type</ccts:DataType> </ccts:Component> </xs:documentation> </xs:annotation> </xs:element> <xs:element ref="cbc:TierRatePercent" minOccurs="0" maxOccurs="1"> <xs:annotation> <xs:documentation> <ccts:Component> <ccts:ComponentType>BBIE</ccts:ComponentType> <ccts:DictionaryEntryName>Tax Subtotal. Tier Rate. Percent</ccts:DictionaryEntryName> <ccts:Definition>Where a tax is tiered, the rate of tax applied to the range of tiers in the calculation of the tax subtotal for the tax category.</ccts:Definition> <ccts:Cardinality>0..1</ccts:Cardinality> <ccts:ObjectClass>Tax Subtotal</ccts:ObjectClass> <ccts:PropertyTerm>Tier Rate</ccts:PropertyTerm> <ccts:RepresentationTerm>Percent</ccts:RepresentationTerm> <ccts:DataType>Percent. Type</ccts:DataType> </ccts:Component> </xs:documentation> </xs:annotation> </xs:element> <xs:element ref="TaxCategory" minOccurs="1" maxOccurs="1"> <xs:annotation> <xs:documentation> <ccts:Component> <ccts:ComponentType>ASBIE</ccts:ComponentType> <ccts:DictionaryEntryName>Tax Subtotal. Tax Category</ccts:DictionaryEntryName> <ccts:Definition>An association to Tax Category.</ccts:Definition> <ccts:Cardinality>1</ccts:Cardinality> <ccts:ObjectClass>Tax Subtotal</ccts:ObjectClass> <ccts:PropertyTerm>Tax Category</ccts:PropertyTerm> <ccts:AssociatedObjectClass>Tax Category</ccts:AssociatedObjectClass> </ccts:Component> </xs:documentation> </xs:annotation> </xs:element> </xs:sequence> </xs:complexType> |

XML Schema documentation generated by XMLSpy Schema Editor http://www.altova.com/xmlspy